Wondering what types of homes you should avoid when buying a home in Calgary? You’re not alone. Many home buyers jump in without realizing that certain properties can come with resale nightmares, location headaches, and hidden costs that only show up after you’ve signed the papers.

In this guide, Calgary Realtor Ryan Gillard shares his expert insights on which types of homes to avoid, and why, so you can make smarter, more confident decisions when entering the Calgary real estate market.

Prefer to watch the video instead? Check out the full YouTube video here.

1. Homes on Busy Roads

Living on a busy road like Anderson or even suburban collector roads might sound manageable, until the constant noise, safety concerns, and poor resale value hit home. Families with young kids, in particular, shy away from these areas, and that affects your potential buyer pool down the road.

Avoid if:

- You’re sensitive to noise

- You want strong resale value

- You have children or plan to

2. Near CTrain Lines, Bus Stops, or Schools

You might think living near transit is a win, but CTrain lines and bus stops bring constant noise and loitering. Even schools can pose resale issues due to traffic, noise, and limited parking.

3. Under the Flight Path

Certain parts of Northeast Calgary sit directly under the YYC flight path. Planes land every few minutes—day and night. Constant air traffic affects your quality of life and property value.

4. Homes Near Power Lines or Cell Towers

Even if you’re okay with the view, many buyers are not. These structures create stigma that sticks around come resale time.

Common comment: “We love the house, but can’t get past the power lines.”

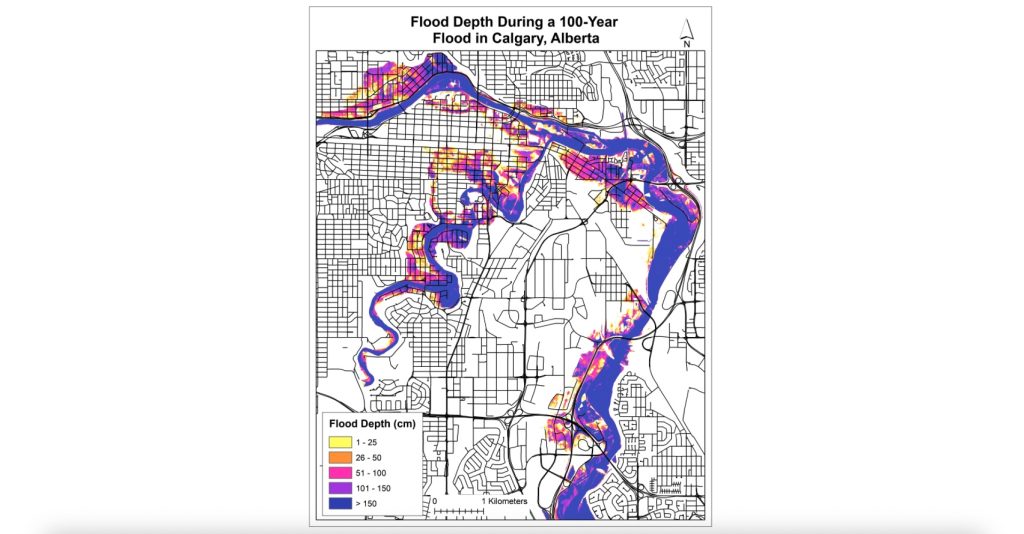

5. Properties in Flood Zones

Buying a home in a flood zone in Calgary can mean costly insurance, resale challenges, and disaster risk.

Check first: Use the City of Calgary’s online flood maps before buying.

6. Ground Floor or Below Grade Condos

These units attract fewer buyers, lack privacy, and can involve break in risk especially in urban areas like the Beltline.

7. Condos with Poor Reserve Funds or Post Tension Cables

New condos may advertise low condo fees but come with issues down the road with inadequate reserve fund contributions due to low condo fees. If the reserve fund is low, you may face major special assessments for repairs.

Post-tension cable buildings can also complicate financing.

Always:

- Review condo docs in detail

8. Brand New Builds in Still-Developing Communities

Buying a new home in developing areas? If you plan to sell in a few years, you’ll be competing with brand new builds which can be difficult.

Builders can offer incentives that hurt resale value for existing homes and most buyers would prefer moving into a brand new home in these areas vs one that has been lived in.

9. Century Homes (Built Pre-1950)

Charming on the outside, money pits on the inside. Older Calgary neighbourhoods like Ramsay or Inglewood often have homes with asbestos, outdated plumbing, electrical, and structural concerns.

Avoid if:

- You’re not handy or experienced

- You don’t want renovation surprises after the inspection

10. The Most Expensive Home on the Block

If you’re buying an extreme outlier property like a $900K home located in an area with mostly $500K homes like Rundle or Marlborough, resale will be tough. Buy within the average home price of the community, not above it.

11. Court-Ordered Sales (Foreclosures)

They sound like a deal, but most sell at market value. Plus, you’ll need an unconditional offer—no inspection, no financing condition, no guarantees.

Better for: Investors with cash, not the average home buyer

12. Former Grow-Op Properties

Even if remediated, homes once used for cannabis grow-ops come with long-term stigma. They’re often flagged by Alberta Health, and buyers shy away due to mold risk.

Avoid if:

- You want broad resale appeal

- You’re seeking traditional financing

13. Over Customized or Odd Layouts

Think indoor pools, split-levels with strange dimensions, or homes with confusing entries. These aren’t everyone’s taste—and that limits resale.

Weird layouts to avoid:

- Backsplits or 3-level split homes

- Homes with 2-bed main floors instead of 3

- Homes entered through the basement etc

14. Mobile Homes on Rented Land

You own the structure but not the land. This limits your equity and makes resale more difficult. Financing can also be a challenge.

Final Thoughts: How Buying the Wrong Home in Calgary Can Cost You

Knowing how buying a home works in Calgary isn’t just about getting a mortgage, it’s about choosing the right home with the best long-term value.

That’s why working with a Calgary Realtor who understands location, market trends, resale value, and hidden costs is crucial.

Work with Ryan Gillard – Your Calgary Real Estate Guide

Buying a home in Calgary doesn’t need to feel overwhelming. Ryan Gillard is a seasoned Calgary real estate agent who’s helped hundreds of buyers avoid costly mistakes and find homes that truly fit their needs.

Thinking about buying in Calgary? Contact Ryan Gillard today.